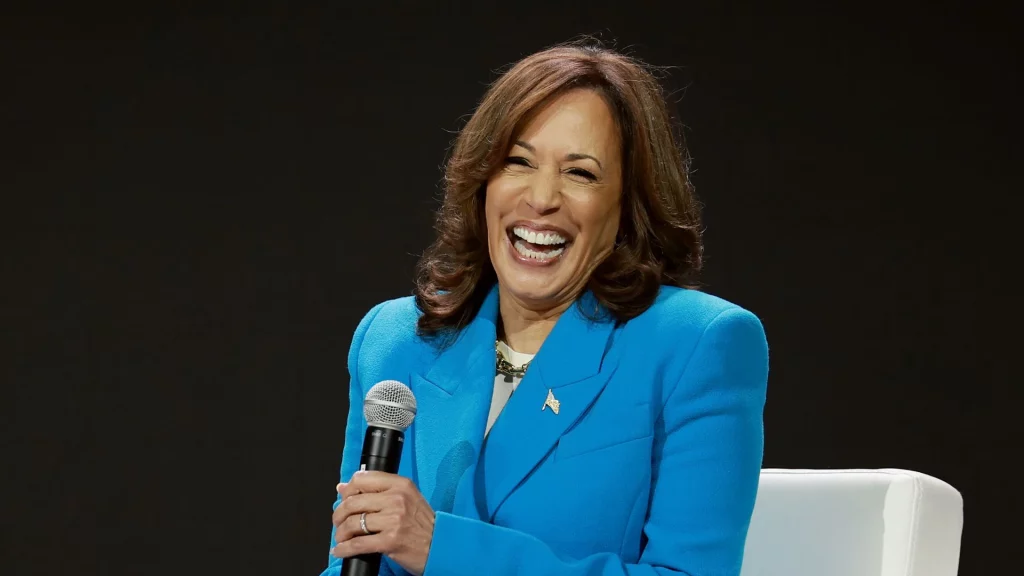

As the United States finds itself at a pivotal crossroads, Vice President Kamala Harris steps forward to grasp the Democratic torch, setting the stage for a momentous clash with former President Donald Trump in the 2024 presidential race. Amidst years of unrelenting inflation, the economy has surged to the forefront of American voters’ concerns. The electorate’s focus sharpens on the divergence between the economic policies of the two-party candidates and the current administration.

Approaching the crescendo of the presidential election, on August 16th, Harris unveiled her inaugural economic policy agenda in a speech that could redefine the financial trajectory of countless American families. Her policy framework zeroes in on the cost of living, with initiatives aimed at reducing food prices, revising tax structures, cutting housing expenses, and curbing healthcare costs. Harris’s vision of an “Opportunity Economy” encompasses tax cuts for the majority, a crackdown on price gouging, a reduction in the cost of essentials such as groceries, and an ambitious plan to construct affordable housing.

Reducing the Cost of Living for American Families

In her address, Harris declared an unprecedented federal initiative to prohibit the price exploitation of food and everyday goods. This would empower agencies such as the Federal Trade Commission (FTC) to investigate and penalize large corporations for anti-competitive practices like price manipulation, intensifying sanctions against those inflating the cost of daily necessities, including gasoline.

Harris’s victory would see the perpetuation of a $3,600 tax credit for eligible families with children and the introduction of a new $6,000 tax relief for households with newborns, along with an expanded Earned Income Tax Credit, offering a $1,500 tax cut for frontline workers. Her proposed “Middle-Class Act” aims to provide a monthly tax rebate of $500 to individuals earning under $100,000, a stark contrast to the tax policies implemented by Trump in 2017.

Confronting the escalating housing prices and rents, Harris’s strategy includes a trifecta of homebuyer subsidies, increased housing supply, and stringent action against malicious rent hikes. She pledges a $25,000 down-payment subsidy for first-time homebuyers and the construction of 3 million new, affordable homes and rental units by the end of her first term, targeting the nation’s housing shortage. Furthermore, Harris commits to tackling corporate landlords’ rent inflation and vows to significantly lower healthcare costs. This includes bolstering federal insurance subsidies on the healthcare marketplace and capping out-of-pocket prescription drug expenses at $2,000 annually, potentially alleviating medical debt for millions of Americans.

The Potential Fiscal Burden

Economists caution that Harris’s economic manifesto, which combines price reductions, tax cuts, and enhanced social security, could exacerbate the U.S. government’s fiscal deficit post-election, intensifying long-term debt pressures.

Research by the Committee for a Responsible Federal Budget (CRFB) indicates that Harris’s economic policies could inflate the U.S. deficit by $1.7 trillion over ten years (FY 2026 to FY 2035). Permanently extending temporary housing policies could amplify this figure to $2 trillion. With the U.S. GDP at $22.4 trillion in 2023, an additional $2 trillion deficit over a decade suggests an average annual increase of 0.9 percentage points in the deficit rate, hinting at a post-election fiscal climate that may lean towards expansion rather than restraint. Notably, this calculation only includes the policies addressed in Harris’s speech and does not account for her proposals on minimum wage increases or expenditures in sectors beyond the economy, such as manufacturing (renewable energy, semiconductors), and immigration, which could further elevate the deficit rate if Harris emerges victorious.

Polls have shown that, on economic matters, the public’s confidence in Trump surpasses that in Harris. For instance, a recent survey by the American Consumer News and Business Channel suggests that voters believe their economic situation would fare better under Trump’s leadership than Harris’s, with a 2:1 ratio favoring Trump on economic grounds. It is noteworthy that Trump has adeptly harnessed the electorate’s economic pessimism to garner support, labeling the recent market downturn as the “Kamala Crash,” a direct attribution to Harris and the Biden administration.