(There are always unconvinced want to try! Nvidia short size has been comparable to Apple and Tesla combined) In Nvidia all the way or is expected to impact the “world stock king”, at least some investors are now betting that it will “fall back” to the ground. According to a report released Thursday by S3 Partners, the amount of open short bets against Nvidia now stands at about $34 billion, almost as much as the next largest short bets, Apple and Tesla combined.

At least some investors are now betting that Nvidia will fall back to Earth as it surges along the way or is poised to smash the “world stock king.”

According to a report released Thursday by S3 Partners, the amount of open short bets against Nvidia now stands at about $34 billion, almost as much as the next largest short bets, Apple and Tesla combined.

S3 data shows that there are currently about $19 billion of open short bets against Apple and about $18 billion on Tesla.

After a multi-day rally, Nvidia shares closed down about 1.18 percent on Thursday after tumbling nearly 6 percent from a record high, giving Apple back its title as the world’s second-most valuable publicly traded company. But even so, Nvidia is still up more than 10% so far this week, and “unlimited” demand for its high-end AI chips has sent Nvidia shares soaring 144% in 2024.

It’s worth noting that, even if the size of the short position seems staggering, short bets on Nvidia currently only amount to about 1% of the stock’s market value, according to LSEG.

Stuart Kaiser, head of U.S. equity trading strategy at Citigroup, said: “Nvidia has the advantage that it is one of the very few companies that can really capture AI revenue. The higher the stock price, the greater the potential for revenue, and of course, the increased risk. But so far, everything looks good.”

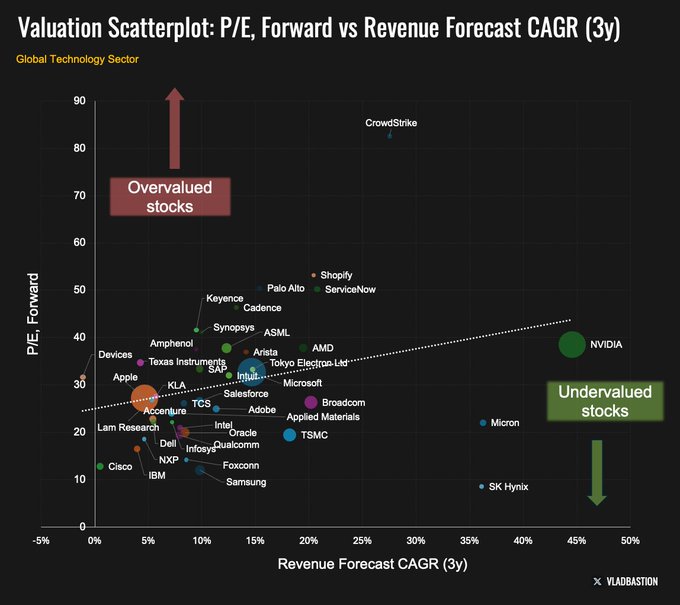

According to industry statistics, from the perspective of forward price-earnings ratio and the compound annual growth rate of revenue in the next three years, Nvidia’s stock price is not currently in the camp of overvalued technology stocks in the United States.

Mizuho Securities recently estimated that Nvidia now controls 70 to 95 percent of the market for AI chips used to train and deploy models such as OpenAI GPT. Nvidia’s pricing power lies in its 78 percent gross margin, which is a very high number for a hardware company that has to make and deliver physical products.

Aswath Damodaran, a finance professor at New York University, said: “If you were to design the perfect dynamic company from the ground up, Nvidia would be it. It’s a great story, a CEO who stuck to his ideals and was comfortable with the combination of market conditions. I think you’re looking at one of the greatest growth stories of all time, playing out right in front of you.”