With the S&P 500 hitting another all-time high for the first time in a month and a half; With the Dow closing above 39,900 for the first time in its history and nearing the 40,000 level, Wall Street seems to have completely calmed down after Wednesday’s release of the April US consumer price data.

The report, which revealed the renewed cooling trend of US inflation, further strengthened the expectation of the Federal Reserve’s interest rate cut in September, and the global market once again staged a “dollar falling everything rising”.

After the overnight rally in all three major U.S. stock indexes, Asian markets also “played and danced” shortly after opening on Thursday. The Nikkei 225 was last up about 0.6 percent on the day, while South Korea’s Kospi jumped to open more than 1 percent higher.

In addition, Australia’s S&P 200 index is currently up 1.3%.

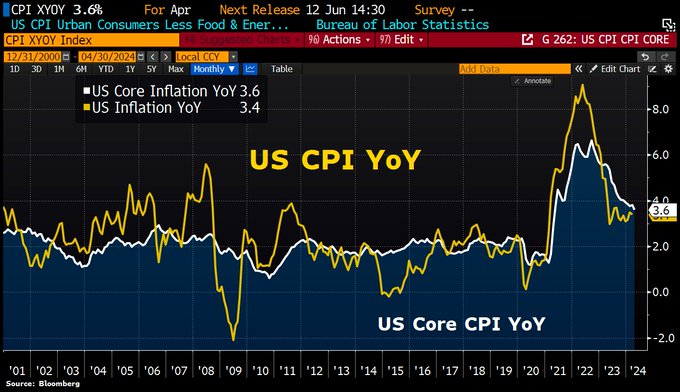

The Consumer Price Index, which measures the cost of goods and services in the US economy, rose 3.4 per cent in April from a year earlier, Labour Department data showed on Wednesday. The so-called core CPI, which strips out volatile food and energy items, climbed 3.6 percent from a year earlier, the slowest pace since April 2021. Both year-on-year figures were in line with the expectations of economists polled by the media.

On the month-on-month front, the US CPI rose 0.3% in April, slightly lower than the 0.4% expected and the previous value. It is the first time in six months that month-on-month CPI growth has slowed.

The CPI report, which shows a cooling trend in prices from many angles, undoubtedly makes market traders further endorse the optimistic tone of the US stock and bond market in advance. Together with some downward revisions to previous data, this was a report that really showed some cooling in inflation, many macro analysts said.

Gennadiy Goldberg, head of U.S. interest rate strategy at TD Securities, said, “Market participants are breathing a sigh of relief that we are not seeing inflation consistently above expectations.”

David Russell, Director of global market strategy at TradeStation, said, “While housing costs have not come down as expected, there have been improvements in transportation and health care. The number is not perfect, but we are gradually moving towards lower inflation. Weakness in retail sales data and the New York Fed’s manufacturing index also suggested that growth was slowing, keeping open the possibility of a rate cut. It’s a triple whammy of good news.”

Other data on Wednesday showed U.S. retail sales were unexpectedly flat in April as higher gasoline prices cut spending on other goods, suggesting consumer spending is losing momentum.