Minneapolis Fed President Neel Kashkari, a hawkish figure within the central bank, said Tuesday that aggressive action has been taken to control U.S. inflation but that it remains higher than policymakers are prepared to tolerate.

He told a recent conference, “Now that inflation is coming down, we’ve made some good progress. But it’s still too high.”

“I would like to see convincing evidence that inflation is coming back down to 2 percent, and then we can give it some time to run.” We don’t have to get there tomorrow, we can make it happen over time.” “He added.

Kashkari is a voting member of the FOMC this year. He said he has been “surprised by how resilient the economy has been” in the face of the Fed’s aggressive campaign of rate hikes to ease inflation, with the labor market “remaining very strong.”

“It’s kind of a double-edged sword because the question in my mind is, ‘Are we doing enough to get inflation back to 2 percent, or do we have to do more?'” ‘” he said.

Policymakers announced a quarter-point increase at their meeting last month, bringing the federal funds rate to a range of 5.25 percent to 5.5 percent. At the June meeting, officials also signaled that two more rate hikes may be necessary this year, after already raising rates once in July, and speculation is rife about whether the next hike will come at the September meeting or whether the cycle is over.

In 2022, US inflation reached its highest level in 40 years. Since then, the Fed has been raising interest rates in an attempt to cool inflation. While price gains have cooled sharply since then, they remain well above the Fed’s 2% annual target rate.

“Are we done raising rates? I’m not ready to say it’s over. Let alone a rate cut, it’s a long way off.” “But I see positive signs that we may be moving forward, that we can take a little more time to observe, get more data, and then decide if we need to do more work,” Mr. Kashkari said.

While a report last week showed inflation continued to slow in July, with prices excluding food and energy rising at the smallest pace in more than two years, strong retail sales data on Tuesday showed U.S. consumption continued to be resilient.

Specific data show that the United States in July retail sales rose 0.7% month on month, four consecutive months of growth, stronger than the market expected 0.4%, year-on-year growth of 3.2%, the data in June also increased from 0.2% month on month to 0.3% Core retail sales rose 1% month on month, also stronger than the previous expected 0.4%. Both sets of data recorded their biggest monthly increases since January.

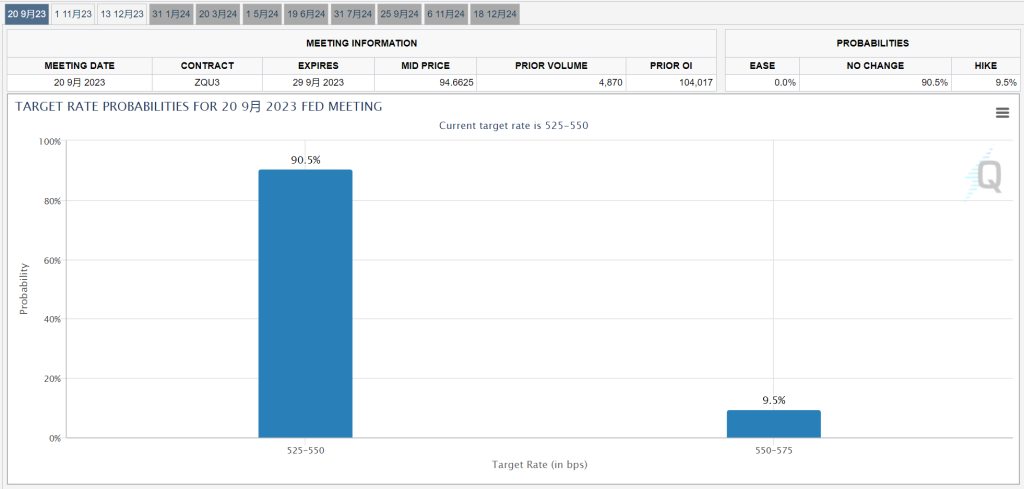

Previously, Fed officials have said they are carefully reviewing incoming data as they set policy. They will meet again on September 19-20 to decide on interest rates. Currently, the market is pricing in a 90.5 per cent chance of the Fed staying its hand and a 9.5 per cent chance of a quarter-point rate hike, according to the CME Fed Watch tool.