Eastern time on Monday (June 3), the New York Stock Exchange said that the issue that caused the abnormal display of some stock prices has been fixed and is investigating.

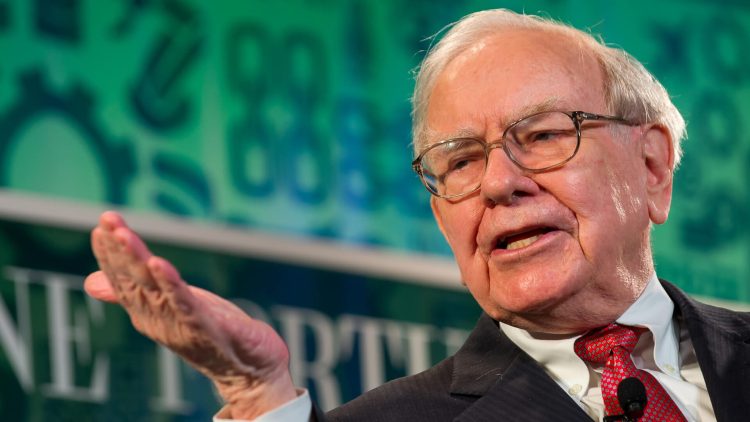

Warren Buffett’s Berkshire Hathaway Class A shares plunged 99.97% to $185.10 in early trading on Monday due to technical problems. Berkshire Hathaway Class B shares were not affected by the technical glitch.

As of Monday’s close, Berkshire Hathaway Class A shares were up 0.59 percent at $631,10.1, while Berkshire Hathaway Class B shares were up 0.09 percent at $414.79.

Berkshire Hathaway Class A shares are not the only ones affected, according to the Unified Securities Quotations Association (CTA), there are dozens of stocks affected, and other well-known stocks involved include Barrick Gold and NuScale Power. CTA is the organization that provides real-time stock quotes to the major exchanges.

As for whether trades completed during the abnormal stock price display were valid, according to media reports, the New York Stock Exchange said in an email that erroneous trades caused by technical problems were considered invalid. Nyse, along with other unlisted Trading Privilege (UTP) exchanges, has ruled to cancel all erroneous trades in Berkshire Hathaway priced at $603,718.30 or less between 9:50 a.m. and 9:51 a.m. Et related to the CTASIP issue.

Under normal circumstances, Berkshire’s Class A shares are among the most expensive on Wall Street, hitting an all-time high closing price of $634,440 on March 28. As of last week, Berkshire’s Class A shares were selling for about 45% more than the median price of a U.S. home.

Berkshire Hathaway Class A shares are so high mainly because Buffett has never split the stock, as he wants to attract shareholders with a long-term investment horizon. Buffett has said that many Berkshire shareholders treat their shares like savings accounts.

Still, Berkshire issued Class B shares in 1996 at 1/30th the price of Class A shares to cater to small investors who wanted a piece of Buffett’s performance.

Buffett is Berkshire’s largest shareholder, owning more than 38 percent of the Class A shares, according to FactSet. Buffett, who has run Berkshire since 1965, has pledged to give away the wealth he has amassed at the company.