The International Monetary Fund (IMF) has once again raised the alarm on global debt levels, issuing a stark warning that the world is heading toward an unsustainable financial future. In a recent report, the IMF highlighted the mounting risks posed by rising debt in both developed and emerging economies. While debt is often seen as a necessary tool for economic development, the current trajectory suggests that the debt burden is becoming increasingly unmanageable, with potential consequences for financial stability worldwide. This article examines the IMF’s findings, the specific challenges facing emerging markets, and the policy solutions proposed to address the global debt crisis.

Introduction: The IMF’s Recent Report on Global Debt and Its Risks to Financial Stability

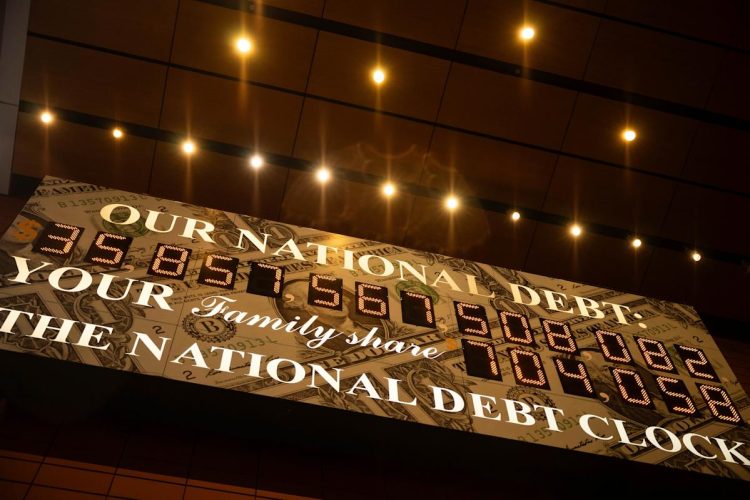

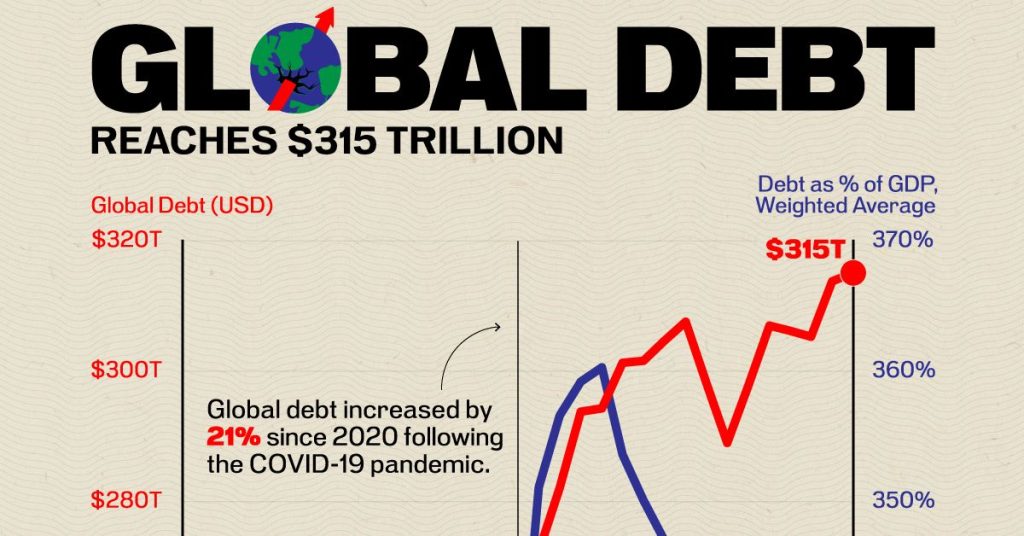

The IMF’s latest report on global debt underscores a critical and growing issue facing the world economy. According to the IMF, total global debt has reached a staggering $300 trillion, representing over 350% of global GDP. This rapid increase in debt levels over the past decade, exacerbated by the COVID-19 pandemic, poses significant risks to the stability of the global financial system. The report warns that if current trends continue, the world could face a series of financial crises, with severe consequences for both developed and developing economies.

While the rise in debt was initially driven by fiscal stimulus measures and central bank interventions in response to the pandemic, it has continued to climb in the years following the initial shock. Governments, businesses, and households around the world have taken on unprecedented amounts of debt in an effort to stay afloat during turbulent economic times. However, this increased borrowing comes with a heavy price, as rising interest rates and inflationary pressures have made debt servicing more expensive, particularly for the most indebted countries.

In addition to the immediate economic impacts, the IMF warns that high debt levels could have long-term consequences for global financial stability. If countries are unable to manage their debt burdens effectively, they may face defaults, currency devaluations, and severe disruptions to economic activity. The IMF’s report calls for urgent policy actions to address the growing debt crisis and prevent further financial instability.

Key Findings: Key Statistics on Rising Global Debt Levels

The IMF’s latest report presents several key findings that shed light on the scale of the global debt crisis and its implications for the future of the global economy. Some of the most alarming statistics include:

- Global Debt Reaches $300 Trillion: Total global debt, including public and private debt, has surged to $300 trillion, up from $270 trillion in 2020. This represents more than three times the size of the global economy. The IMF notes that this unprecedented rise in debt is largely due to government borrowing in response to the COVID-19 pandemic, as well as increased corporate borrowing driven by low-interest rates and easy credit conditions.

- Debt-to-GDP Ratios at Historic Highs: Debt-to-GDP ratios across the globe have reached historic highs, particularly in advanced economies. In many developed countries, government debt levels are approaching or exceeding 100% of GDP, a level that is often considered unsustainable in the long term. Emerging markets are also seeing rising debt levels, with many countries in sub-Saharan Africa and Latin America experiencing rapid increases in both public and private debt.

- Rising Interest Rates and Debt Servicing Costs: One of the most concerning trends identified by the IMF is the sharp rise in interest rates in many parts of the world. The US Federal Reserve, the European Central Bank (ECB), and other central banks have raised rates in an effort to combat rising inflation. While these rate hikes are necessary for controlling inflation, they also make debt servicing more expensive, particularly for countries with high levels of debt. The IMF estimates that the cost of servicing global debt could rise by $3 trillion in the coming years, putting additional strain on heavily indebted nations.

- Increased Risk of Defaults: The IMF report highlights the growing risk of debt defaults, particularly in emerging markets. In the wake of the pandemic, many countries in the Global South have struggled to manage their debt loads, and rising interest rates and inflation are only making the situation worse. The IMF warns that if countries are unable to meet their debt obligations, there could be a wave of defaults that destabilizes global financial markets and disrupts trade and investment flows.

These statistics paint a grim picture of the global debt landscape, with debt levels continuing to rise at an unsustainable pace. The IMF’s findings underscore the urgent need for policy solutions that address both the short-term and long-term risks associated with high debt levels.

Impact on Emerging Markets: The Particular Challenges Faced by Developing Economies

While rising global debt affects both developed and emerging economies, the challenges faced by developing countries are particularly acute. Emerging markets have been hit hardest by the rising cost of debt, as they often rely on foreign capital to finance infrastructure projects and development initiatives. The combination of high debt levels, rising interest rates, and currency depreciation is creating a perfect storm for many countries in the Global South.

Rising Borrowing Costs and Debt Servicing Strain

Emerging market economies have seen their borrowing costs increase sharply as global interest rates rise. Many of these countries have foreign-currency-denominated debt, meaning that they are particularly vulnerable to exchange rate fluctuations. As their currencies weaken against the US dollar, the cost of servicing foreign debt increases, making it even more difficult to meet debt obligations.

For example, countries like Argentina, Turkey, and South Africa are facing rapidly increasing debt servicing costs, and their governments are struggling to balance the need to service debt with the need to invest in economic growth and poverty reduction. In some cases, these countries may be forced to cut social spending or delay infrastructure projects in order to make debt payments, exacerbating economic inequality and undermining long-term growth prospects.

Debt Crises and Defaults

The IMF report also highlights the growing risk of debt defaults in emerging markets. In recent years, several countries in the Global South have already defaulted or restructured their debt, including Zambia, Sri Lanka, and Ethiopia. These defaults are often triggered by a combination of high debt levels, falling commodity prices, and unfavorable exchange rate movements.

As the global economy faces more uncertainty, the risk of further defaults is rising. The IMF warns that the likelihood of widespread debt restructuring in emerging markets is increasing, particularly as the economic fallout from the pandemic continues to affect growth prospects in developing economies.

Limited Access to Financing

Emerging markets are also facing limited access to financing from international capital markets. As global debt levels rise and interest rates increase, investors are becoming more cautious about lending to high-risk countries. This has made it more difficult for emerging market economies to access the funds they need for development and infrastructure projects.

As a result, many emerging economies are turning to multilateral institutions like the IMF and the World Bank for assistance. However, these institutions have limited resources, and their lending programs are often subject to stringent conditions, including austerity measures and structural reforms that can have negative social and economic consequences.

Policy Solutions: What Measures Are Being Proposed to Curb the Rising Debt Burden?

The IMF’s report calls for a range of policy solutions to address the global debt crisis and reduce the risks associated with high debt levels. These measures are aimed at both developed and developing economies and include fiscal reforms, debt restructuring, and improved coordination between international financial institutions.

Fiscal Reforms and Budgetary Discipline

One of the key recommendations from the IMF is for countries to implement fiscal reforms that promote budgetary discipline and reduce reliance on debt. For developed economies, this means implementing policies that reduce budget deficits and bring public debt under control. The IMF suggests that advanced economies should prioritize fiscal consolidation by reducing non-essential spending and increasing tax revenues, thereby creating fiscal space for future economic challenges.

For emerging markets, the IMF recommends that governments adopt more flexible fiscal frameworks that allow for greater policy room in times of economic distress. This includes creating stronger social safety nets and prioritizing investment in areas like education, healthcare, and infrastructure that can drive long-term growth.

Debt Restructuring and Relief Programs

The IMF also emphasizes the need for a more coordinated approach to debt restructuring and relief. The report calls for a global framework that makes it easier for countries to restructure their debt without triggering a full-blown financial crisis. This could include mechanisms that allow for debt forgiveness, as well as the creation of a multilateral debt restructuring platform to facilitate negotiations between debtor countries, creditors, and international institutions.

Improving Financial Stability and Global Cooperation

The IMF also advocates for stronger global cooperation to address the risks posed by rising debt. This includes improving financial stability frameworks and ensuring that international institutions like the IMF and the World Bank have the resources they need to respond effectively to debt crises. Additionally, the IMF suggests that countries need to improve their transparency and reporting on debt, making it easier for investors and policymakers to assess the risks associated with borrowing.

Conclusion

The IMF’s warning about the rising global debt burden is a stark reminder of the risks facing the world economy. While debt can be a useful tool for financing growth and development, the current trajectory is unsustainable and poses significant risks to financial stability. The challenges facing emerging markets are particularly acute, and urgent policy measures are needed to address the growing debt crisis. By implementing fiscal reforms, restructuring debt, and improving global cooperation, it may be possible to stabilize the global economy and prevent a future debt crisis. However, this will require coordinated action from both developed and developing economies, as well as international financial institutions, to mitigate the risks of unsustainable debt.