Introduction

In recent years, Europe has emerged as a leader in the global push for sustainability, with green policies at the heart of its economic agenda. The European Union (EU) has been adopting ambitious regulations aimed at combating climate change, reducing emissions, and promoting a sustainable, circular economy. These policies, which include the European Green Deal and the Fit for 55 package, have profound implications for various industries, reshaping markets and creating new investment opportunities. This article explores the objectives of EU green policies, the industries most affected by these regulations, and how investors can capitalize on Europe’s green transition.

1. Overview of EU Green Policies and Their Objectives

At the core of the EU’s green agenda is the European Green Deal, a comprehensive policy initiative aimed at transforming the EU into a climate-neutral economy by 2050. This deal sets the stage for sweeping changes in how energy is produced, how industries operate, and how resources are used. The EU’s green policies are designed to reduce greenhouse gas emissions, foster innovation in clean energy, and encourage sustainability across all sectors of the economy.

The Fit for 55 package, introduced in 2021, is another key component of the EU’s green transition. It aims to reduce carbon emissions by 55% by 2030 compared to 1990 levels, which will have wide-reaching implications for energy, transportation, agriculture, and industry. Policies under this package include tightening emissions trading systems, expanding renewable energy sources, and setting stricter fuel efficiency standards for vehicles.

The EU Taxonomy for Sustainable Activities provides a framework for identifying which economic activities can be classified as environmentally sustainable. This regulation encourages businesses to adopt sustainable practices and makes it easier for investors to direct funds toward green projects. Additionally, the EU is working on a Carbon Border Adjustment Mechanism (CBAM) to impose tariffs on carbon-intensive goods entering the EU from non-EU countries, further incentivizing global companies to reduce their emissions.

2. How Green Regulations Are Reshaping Industries Across Europe

The implementation of green regulations has had a significant impact on various sectors within the European economy. Some industries are thriving in response to these changes, while others are facing increasing pressures to adapt.

Energy and Renewable Sector

The green policies of the EU are having a profound impact on the energy sector, with renewable energy sources like solar, wind, and hydropower taking center stage. The EU aims to increase the share of renewable energy in its overall energy mix to 40% by 2030, a goal that has led to significant investments in clean energy projects. Energy companies that focus on renewable sources, energy storage, and green hydrogen production are benefiting from the EU’s focus on sustainability.

The shift towards renewable energy is also accelerating innovation in energy storage technologies. As the demand for intermittent renewable sources like wind and solar grows, so does the need for efficient storage solutions. Battery manufacturers and companies involved in energy storage are seeing significant growth as a result.

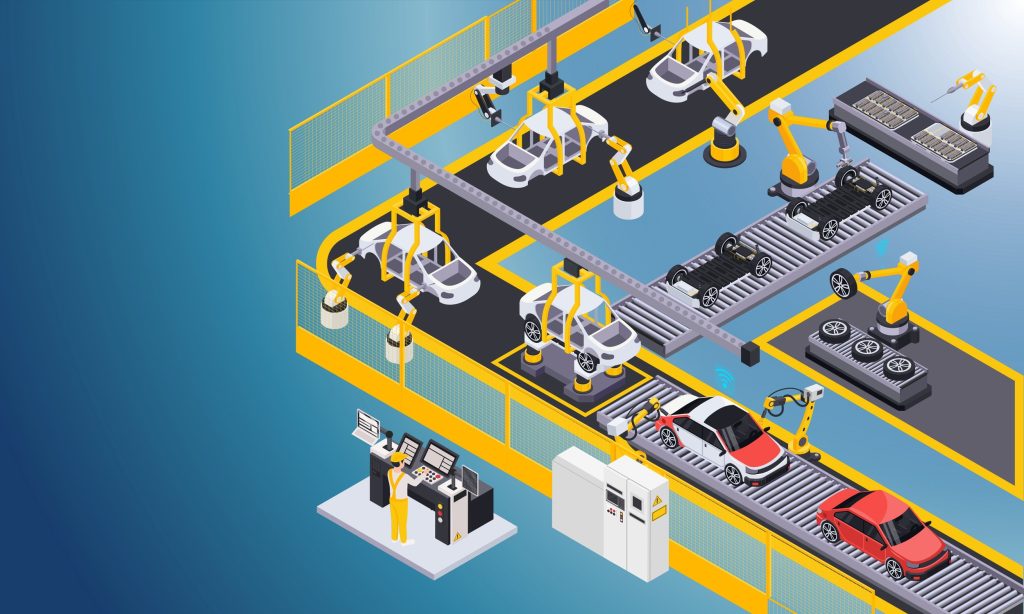

Automotive and Transportation

The automotive industry is undergoing a major transformation due to EU green policies aimed at reducing emissions from internal combustion engine vehicles. Under the Fit for 55 package, the EU has set a target to reduce carbon emissions from cars and vans by 55% by 2030, with the goal of achieving net-zero emissions by 2035. This has led to an increased focus on electric vehicles (EVs) and the infrastructure needed to support them, such as charging stations.

Automotive manufacturers that are investing in EV production are seeing growth in response to these policies. Additionally, companies involved in the supply chain for EVs—such as battery producers, semiconductor manufacturers, and charging infrastructure providers—are benefiting from the push toward green transportation.

Real Estate and Construction

The EU’s green policies are also reshaping the construction and real estate industries. The Renovation Wave initiative, which aims to double the renovation rate of buildings by 2030, is creating opportunities for companies involved in energy-efficient construction, retrofitting, and green building materials. The EU’s focus on sustainable buildings has led to an increase in demand for low-carbon construction materials, such as sustainable steel, timber, and green cement.

Additionally, the EU’s emphasis on energy-efficient buildings and reducing the carbon footprint of the real estate sector is fostering growth in smart home technologies, energy-efficient appliances, and sustainable building designs.

Agriculture and Food Industry

Agriculture is another sector heavily impacted by EU green policies. The EU’s Farm to Fork strategy aims to make food systems fair, healthy, and environmentally-friendly. This includes reducing the use of pesticides and fertilizers, promoting organic farming, and increasing the sustainability of food production and consumption.

Investors are increasingly looking at companies in the agriculture and food sectors that are embracing sustainable practices, such as those focusing on plant-based foods, organic farming, and regenerative agriculture. The demand for sustainable food products is growing as consumers become more environmentally conscious, and companies that align with these preferences are well-positioned to benefit from the EU’s green transition.

3. Investment Opportunities in Sustainable Sectors

The green policies of the EU are creating a wide range of investment opportunities in sustainable sectors. These opportunities are not limited to the renewable energy space but extend to various industries that are embracing sustainability.

Renewable Energy

Investors can look at companies involved in solar, wind, and hydropower energy generation, as well as those developing new energy storage solutions and green hydrogen technologies. The renewable energy sector is likely to see significant growth as the EU works toward its climate goals, offering ample opportunities for long-term investments.

Electric Vehicles and Charging Infrastructure

The automotive sector is shifting rapidly toward electric vehicles, and companies that are at the forefront of EV manufacturing and EV infrastructure are likely to see substantial growth. Investors should focus on automakers that are accelerating their transition to electric mobility, as well as companies involved in EV battery production, semiconductor manufacturing, and charging station networks.

Green Building Materials and Smart Technology

The construction industry offers opportunities for investment in companies producing sustainable building materials, as well as those involved in the growing field of smart home technologies. With the EU’s push for energy-efficient buildings, investors can benefit from companies providing eco-friendly building solutions and smart technology solutions that reduce energy consumption.

Sustainable Agriculture and Food

The food industry’s shift toward sustainability presents opportunities for investment in plant-based food companies, organic farming initiatives, and companies focused on sustainable agriculture practices. Investors should also consider businesses that are developing new sustainable food products, such as alternative proteins and lab-grown meat.

4. Expert Advice on Aligning Portfolios with Europe’s Green Transition

As Europe accelerates its green transition, investors should consider aligning their portfolios with the sustainable sectors that stand to benefit from these changes. Here are some expert recommendations:

Focus on Long-Term Trends

The EU’s green policies are not short-term fixes; they are long-term structural changes. Investors should focus on sectors with strong long-term growth potential, such as renewable energy, electric vehicles, and sustainable agriculture. These sectors are aligned with the EU’s climate goals and are likely to see continued growth over the coming decades.

Diversify Across Sectors

While green policies are reshaping industries, it is important for investors to diversify across multiple sectors. Investing in a mix of renewable energy, electric vehicles, sustainable construction, and sustainable food companies can help reduce risk and provide exposure to a broad range of growth opportunities.

Consider ESG (Environmental, Social, Governance) Factors

When selecting investments, investors should consider companies with strong ESG practices. Many of Europe’s green policies are focused on promoting sustainable business practices, and companies that align with these principles are more likely to succeed in the long run. ESG-focused funds and exchange-traded funds (ETFs) can offer a way to invest in a diversified portfolio of companies that meet high environmental and social standards.

5. Conclusion

The European Union’s green policies are transforming industries and creating new investment opportunities across multiple sectors. As the EU works toward its climate goals, investors have a unique opportunity to capitalize on the growing demand for sustainable products and services. By aligning portfolios with the green transition, diversifying investments, and focusing on long-term trends, investors can navigate the evolving landscape and contribute to a sustainable future.