European Central Bank chief economist Philip Lane said Monday that the full impact of the ECB’s monetary tightening has yet to be felt, even though a June rate cut seems all but assured.

“While the impact of the tightening cycle on economic activity probably reached its maximum early in the year, model-based analysis suggests that most of the impact on inflation is relatively retroactive and is still expected to generate substantial pass-through effects for some time to come,” he said.

He said the current cooling process, which has brought inflation towards its 2 per cent target, would continue into next year. This dynamic, he noted, is “consistent with inflation stabilising on our objective later in 2025 and a substantial recovery in the economy.”

Earlier on Monday, Lane said the ECB would start cutting interest rates next month. “Barring a major surprise,” he said, “what we’re seeing right now is enough to lift restrictions at the highest level.”

More and more officials have been asked recently what will happen after they plan to cut interest rates next month. Most are reluctant to even comment on the future path of monetary policy, given factors such as uncertainty over wage growth and war in the Middle East.

In response, Lane said service sector inflation is proving tricky due to continued strong wage growth for workers and the ECB must keep its restrictive policy in place throughout 2024.

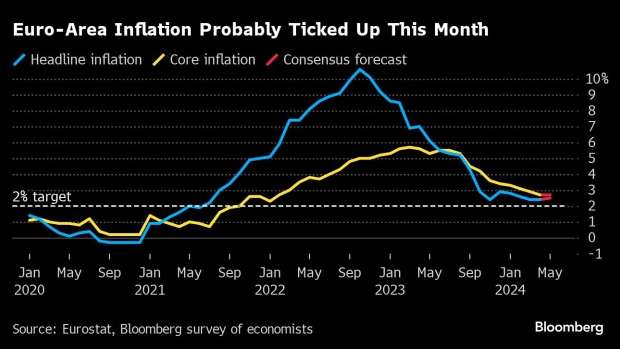

Price inflation in the Group of 20 economies held steady at 2.4 per cent in April from a year earlier, and analysts polled by the media expect it to rise 2.5 per cent in May. Policymakers have stressed that the road to the 2% target will be bumpy.

Lane said, “In determining the appropriate path of policy rates, we will continue to follow a data-dependent and meeting-by-meeting approach to determine the appropriate level and time limit for interest rates, and we do not pre-commit to a particular rate path.”

“The best description of this year is that we need to be strictly limited throughout the year. But within the limits, we can go lower. Next year, with inflation clearly close to the target, and then making sure that interest rates come down to a level consistent with the target, that would be a different topic of discussion.” “He added.